The Convenience of Using a Free Paystub Generator

In today’s fast-paced world, managing payroll efficiently is crucial for businesses of all sizes. Whether you’re a small business owner, a freelancer, or managing a large workforce, keeping track of employees’ earnings and deductions accurately is essential. This is where free paystub generators come into play, offering a convenient solution to generate paystubs quickly and hassle-free.

Introduction

Before diving into the benefits and features of free paystub generators, let’s understand what they are. A paystub generator is an online tool that allows users to create professional-looking paystubs in minutes. These tools are designed to automate the generation of paystubs, saving time and effort for employers and employees alike.

Benefits of Using a Free Paystub Generator

Time-saving

Using a free paystub generator eliminates the need for manual calculations and formatting, saving significant time for employers. With just a few clicks, paystubs can be generated instantly, freeing up valuable time to focus on other essential tasks.

Cost-effective

Unlike traditional paystub creation methods, such as hiring a professional accountant or purchasing expensive software, free paystub generators offer a cost-effective solution. Since they are accessible online, businesses can save money on payroll management.

Accuracy

Manual calculations are prone to errors, leading to employee pay discrepancies. Free paystub generators ensure accuracy by automatically calculating wages, deductions, and taxes based on the information provided. This reduces the risk of mistakes and ensures that employees are paid correctly.

Features to Look for in a Free Paystub Generator

When choosing a free paystub generator, it’s essential to consider the following features:

Customization options

Look for a generator to customize paystubs with your company logo, branding, and specific information. This adds a professional touch to the paystubs and ensures consistency with your brand identity.

Security measures

Ensure the paystub generator employs robust security measures to protect sensitive employee information. Look for encryption and secure data storage to safeguard confidential data.

Integration capabilities

Choose a paystub generator that integrates seamlessly with your existing payroll system or accounting software. This streamlines the process of generating paystubs and ensures compatibility with your workflow.

How to Use a Free Paystub Generator

Step-by-step guide

Creating paystubs using a free generator is simple. Follow these steps:

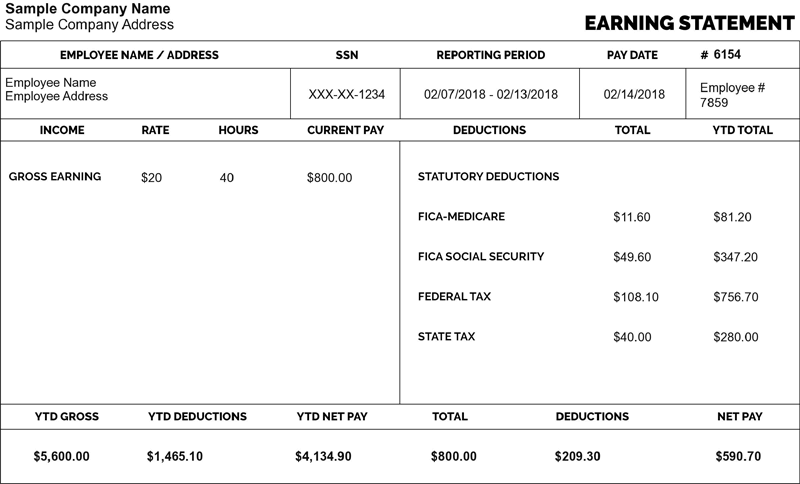

Entering basic information

Start by entering basic details such as the employee’s name, address, and pay period dates.

Adding income details

Enter information about the employee’s earnings, including hourly rate or salary, total hours worked, and any overtime pay.

Deductions and taxes

Input deductions include taxes, insurance premiums, retirement contributions, and other withholdings.

Additional information

Include any additional information required, such as reimbursements, bonuses, or commission earnings.

Downloading and printing options

Once all the necessary information has been entered, you can preview the paystub and download it in PDF format for printing or distribution to employees.

Importance of Accurate Paystubs

Accurate paystubs are essential for several reasons:

Legal compliance

Employers are required by law to provide employees with accurate paystubs that detail their earnings and deductions. Failure to do so can result in legal consequences and penalties.

Employee satisfaction

Providing employees with clear and transparent paystubs instills trust and confidence in the organization. It also helps prevent disputes or misunderstandings regarding pay.

Financial management

Accurate paystubs enable employees to track their earnings, deductions, and taxes, helping them budget and plan their finances effectively.

Common Mistakes to Avoid

When using a paystub generator, avoid the following mistakes:

Incorrect information

Double-check all information entered into the generator to ensure accuracy. Mistakes such as typos or incorrect figures can lead to paystub errors.

Omitting important details

Ensure that all relevant information, such as deductions and taxes, is included in the pay stub. Omitting crucial details can result in accuracy and legal compliance issues.

Using unreliable generators

Choose a reputable and reliable paystub generator to avoid errors and ensure the security of sensitive information.

Tips for Choosing the Right Paystub Generator

To select the best paystub generator for your needs, consider the following tips:

Reading reviews

Read reviews and testimonials from other users to gauge the reliability and performance of the paystub generator.

Checking for customer support

Choose a generator that offers reliable customer support if you encounter any issues or need assistance.

Testing features

Please take advantage of free trials or demos to test the features and functionality of the paystub generator before committing to it.

Alternatives to Free Paystub Generators

While free paystub generators offer convenience and affordability, there are alternative options available:

Paid software options

Consider investing in paid payroll software with advanced features and capabilities, such as automated tax calculations and employee self-service portals.

DIY templates

Create custom paystub templates using spreadsheet software or word processing programs. While this option requires more effort, it allows for greater flexibility and customization.

Frequently Asked Questions (FAQs)

What is a paystub generator?

A paystub generator is an online tool that allows users to create professional-looking paystubs quickly and easily.

Are free paystub generators reliable?

Yes, many free paystub generators are reliable and accurate, provided they are used correctly and come from reputable sources.

Can I customize my pay stub using a free generator?

Yes, most free paystub generators offer customization options, allowing you to add your company logo, branding, and specific information.

Do free paystub generators calculate taxes automatically?

Some free paystub generators offer automatic tax calculations based on the information provided, while others may require manual input of tax amounts.

Is it legal to use free paystub generators for business purposes?

Yes, using free paystub generators for business is legal as long as the generated paystubs are accurate and comply with relevant laws and regulations.

Conclusion

Free paystub generators offer a convenient and cost-effective solution for businesses to generate accurate paystubs quickly. By considering the features, avoiding common mistakes, and following selection tips, companies can streamline their payroll processes and ensure compliance with legal requirements. Whether you’re a small business owner or a freelancer, utilizing a free paystub generator can save time, money, and effort in managing payroll effectively.